Nakheel and Meydan merge to form Dubai Holding

Dubai real estate developers,

Nakheel

and Meydan, have announced their merger to join Dubai Holding. The aim of this operation is to create a more financially efficient entity with assets worth several hundred billion and global expertise in various sectors.

Nakheel and Meydan: two real estate giants in Dubai

Nakheel is famous for being the group behind Dubai’s palm-shaped islands. It was taken over by the government in 2011 as part of a $16 billion rescue package following the 2009-2010 real estate crisis. Meydan is another major real estate developer also operating in Dubai.

New projects planned after the merger

- Creation of a more financially efficient entity

- Estimated asset value in the hundreds of billions

- Global expertise in sectors such as hospitality, healthcare and education

- Opportunity to expand into international markets

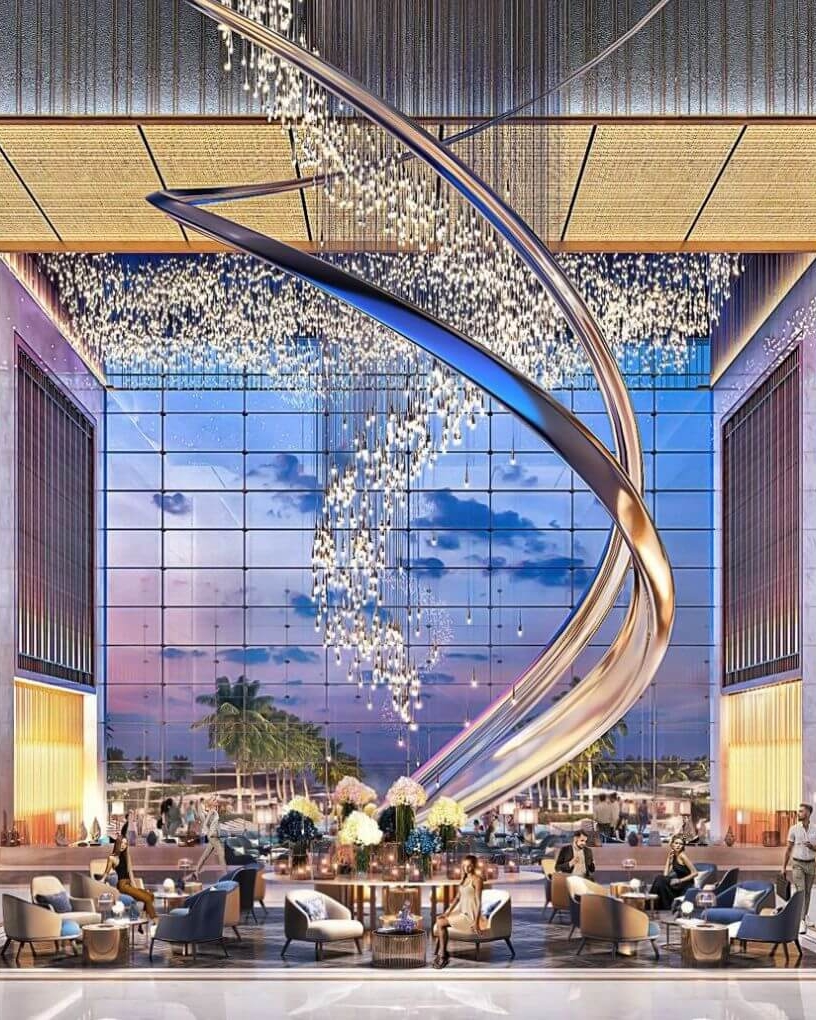

With this merger, the newly-created entity is set to focus on a number of innovative projects in fields such as hospitality,

A strategic decision for sustainable growth

The merger of Nakheel and Meydan represents a strategic decision in the current economic climate. The two companies will be able to pool their resources and take advantage of the resulting synergies to ensure sustainable growth. In addition, being part of Dubai Holding will give the new entity greater visibility on the financial markets.

Implications for the Dubai real estate market

This merger between Nakheel and Meydan will also have repercussions on the Dubai real estate market. In particular, it should enable us to better respond to market needs in terms of housing and various infrastructures. It will also reinforce the city’s image as a major international real estate center.

Challenges facing the new merged entity

While this merger has many advantages, it also raises certain challenges that the new entity will have to face:

- Ensure seamless integration of Nakheel and Meydan teams and corporate cultures

- Implement effective management processes to optimize performance and results

- Determine investment priorities and define clear objectives for individual projects

- Managing risks related to global real estate and economic trends

However, the new entity has all the cards in its hand to succeed in this new competitive landscape. The merger with Meydan will enable Nakheel to strengthen its expertise and position in the Dubai real estate market. What’s more, joining Dubai Holding offers unique opportunities in terms of financing and access to a global network of key players.

The merger of Nakheel and Meydan into Dubai Holding marks a major turning point in the history of Dubai’s real estate sector. It will help create a solid, innovative entity capable of coping with the rapid evolution of global real estate markets. For market players, this is further proof of the ability of Dubai’s companies to adapt to present and future economic and competitive challenges.