The UAE real estate market is the fastest growing in the EMEA region in 2021, and almost 80% of real estate professionals are convinced that the UAE real estate market will continue to accelerate in the current year.

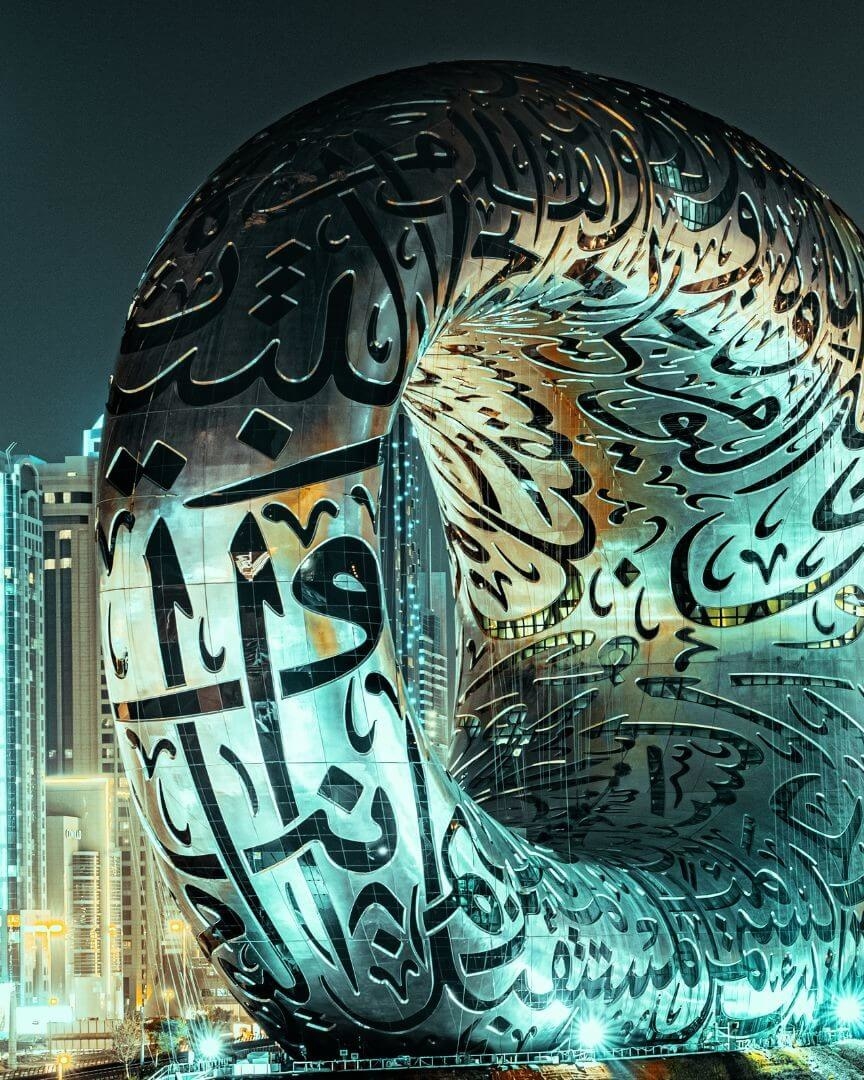

While the UAE’s ultimate goal is to position Dubai as the world’s leading tourist destination and commercial hub, the Tourism Board’s mission is to raise its profile with the international public and attract foreign tourists and investors to this futuristic El Dorado.

2021, an unprecedented record year

The figures speak for themselves. Dubai’s real estate market proved remarkably resilient during the pandemic.

Slowing down since 2017, the Emirati economy has been severely weakened by Covid-19 through the collapse in oil prices, while the majority of state revenues are based on hydrocarbons. As a result, Emirati GDP fell by 6.1% in 2020.

The pandemic has also had a major impact on the non-oil sector, which relies mainly on services (tourism, real estate, distribution, air and sea transport) and of which Dubai is the spearhead. The non-oil sector thus recorded a 6.2% recession in 2020.

Nevertheless, the country’s economic fundamentals remained solid thanks to Abu Dhabi and a gradual recovery in activity. In the last quarter of 2021, the real estate market in the United Arab Emirates experienced record growth since its inception.

In November 2021, Dubai recorded its best sales month ever, with a total of 6,989 transactions worth 17.95 billion dirhams.

In terms of transaction volumes, Dubai has identified a total of 60,900 for 2021, representing a 75% increase on 2020 and a 55% increase on 2019.

This trend can be explained by a number of key factors in 2021:

– The Dubai authorities reacted particularly well to the Covid-19 crisis, managing it rapidly with mass vaccination from the very start of the pandemic. Sanitary protocols, on the other hand, were fairly well respected by the population and tourists alike.

– A meteoric 57% increase in the number of real estate agents, working for over 1,800 real estate agencies in Dubai.

– Support for the World Expo, which begins in October 2021. An event that sparked an explosion in tourist numbers.

– Unprecedented demand from global investors seeking alternative residency and citizenship options following the turbulence and uncertainty caused by the COVID-19 pandemic.

–Strong demand for luxury properties, where the volume of sales of apartments worth more than AED 10,000,000 has increased by 235% compared to 2021 and by 115% compared to 2013.

Some figures on the evolution of the number of sales recorded over the year 2021 in Dubai, by property type (according to Dubai Land Department):

39,600 apartments (+60.98% compared with 2020)

8,700 villas (85.69% compared with 2020)

2,400 commercial premises (103.71% compared with 2020) 10,300 plots of land (115.53% compared with 2020)

Focus on property price trends in Dubai in 2021

It’s important to note that Dubai’s real estate market in 2021 will be characterized by three major trends: a rise in demand for luxury apartments, a massive increase in villa sales and a sharp rise in rental prices across the city.

This set new all-time records, including the highest sales value ever recorded, at over AED 150 billion, and one of the highest sales volumes since 2013, with over 60,500 properties.

It’s also the best year ever for on-plan property sales volume, with 25,000 properties sold throughout 2021.

We also boast the highest volume of villa sales ever recorded in Dubai’s history, with some 7,580 off-plan villas and 6,000 villas for secondary purchase. On the apartment side, we also set a record since 2013, with an explosive sales counter of 39,570 apartments.

In addition, more than 35,000 properties have been delivered and another 21,500 launched. More than 55,000 properties are scheduled for delivery in 2022.

As a result, Dubai’s real estate market has recovered and performed well beyond expectations.

A global event with an impact on property prices in Dubai

The year 2021 records 25,280 off-plan transactions, an increase of 51% on 2020, while ready-to-use property transactions have risen by 92% on 2020 to 36,400 transactions. Fäm Properties expects to deliver over 35,000 units by 2021. Emaar leads the way with 20%, Damac 16% and Dubai Properties 4%.

We have detailed the main delivery areas for investors in 2021:

- MBR City, 13,447 (11%)

- Business Bay, 12,458 units (11%)

- Marina, 7,214 units (6%)

- Damac Hills, 7,210 units (6%)

- Downtown, 5,908 (5%)Compared with 2020, units launched increased by 69.83 % to over 21,700 units, representing 103 real estate projects. Properties launched are mainly concentrated in Mohammad Bin Rashid Al Maktoum City (3,626 units), Damac Hills Dubai (3,377 units), Business Bay (1,898 units), Jumeirah Village Circle (1,535 units), Dubai Investment Park (1,174 units), Al Furjan (1,168 units) and Arabian Ranches (1,023 units).

Dubai, a fascinating real estate destination

The Persian Gulf’s flagship city welcomed 7.28 million visitors worldwide, for one night or more, between January and December 2021.

Representing growth of 32% over the year, this marks a significant step in the recovery of global tourism, and puts the city on the path to sustainable growth, on its way to becoming the world’s most visited destination.

According to the latest data published by the Department of theDubai Department of Economy and Tourism (DET)International visits to the city exceeded 3.4 million in Q4 2021, reaching 74% of total tourist arrivals prior to the pandemic in Q4 2019.

Hotel occupancy levels even exceeded pre-pandemic levels, with an average occupancy rate of 67%, representing one of the highest occupancy rates in the world.

This positive trend is set to continue throughout the current year. Indeed, visitor numbers for 2021 demonstrate the resilience of the destination and the recovery of the tourism sector.

They reaffirm the sector’s role as a key driver of economic growth, while lending further credibility to Dubai’s recent accolade as the world’s most popular destination in the Tripadvisor Travellers’ Choice Awards 2022.

Dubai’s real estate prices are far more affordable than those of the world’s other major metropolises.

In fact, you only need to compare real estate prices, particularly per m2 in Dubai and other cities such as Paris, London or New York, to notice a remarkable difference. Similarly, Dubai’s real estate market is managed efficiently and effectively.

The report notes that the first half of 2022 saw a number of successful and noteworthy project launches, achieved in the wake of renewed optimism in the real estate market. The latter was initially supported by a strong secondary market.

More articles on real estate in Dubai

Dubai real estate figures: 2023

6 January 2024

lire l'article →

Dubai real estate figures: June 2023

12 July 2023

lire l'article →

- Home

- Real estate in Dubai

- Market Overview

- Dubai real estate figures for 2021